Unveiling the Golden Connection: US Economy and the Price of

The allure of gold has captivated humanity for centuries, and its role as both a symbol of wealth and a store of value remains unwavering. However, the price of this precious metal isn't set in stone; it's subject to the ebb and flow of global economics. In this in-depth exploration, we'll delve into the intricate dance between changes in the US economy and the ever-shifting landscape of gold prices. By the end of this journey, you'll possess a profound understanding of the multifaceted factors that shape gold market trends, as well as how economic indicators can significantly impact your gold investments.

The US Economy: A Driving Force Behind Gold Prices

As the world's largest economy, the United States wields immense influence over the price of gold. Alterations in the US economic landscape send reverberations throughout the global financial sphere, making it a key focus for gold investors worldwide. Let's take a closer look at the mechanisms at as a safe haven. Economic recessions, financial crises, or geopolitical uncertainties often trigger this flight to safety. During these turbulent times, the value of gold tends to rise, reflecting increased demand from investors seeking refuge from market volatility.

Monetary Policy and Interest Rates

The policies set by the US Federal Reserve play a pivotal role in shaping the economic landscape and, subsequently, gold prices. Fluctuations in interest rates wield substantial influence. When interest rates are lowered to stimulate economic growth, it can reduce the opportunity cost of holding non-yielding assets like gold, making gold more attractive to investors.

Inflation and the Devaluation Hedge

Gold has historically been a hedge against inflation. When inflation rates rise, the real value of currency decreases, and investors turn to tangible assets like gold to preserve their wealth. This relationship often results in an upward trajectory for gold prices during inflationary periods.

Global Events and Geopolitical Tensions

Global events and geopolitical tensions can send shockwaves through financial markets, prompting investors to seek the safety of gold. Trade disputes, political unrest, or even natural disasters can create uncertainty and drive-up demand for the precious metal.

Dollar Strength and Gold

The intricate dance between the US dollar and gold prices is a captivating aspect of the precious metals market. The value of the US dollar plays a significant role in influencing the price of gold, and this relationship is characterized by a strong inverse correlation. Understanding how this dynamic works is essential for anyone looking to invest or trade in the gold market.

A robust US dollar often exerts downward pressure on gold prices. This phenomenon occurs for several reasons:

- Foreign Exchange Impact: When the US dollar is strong, it means that it has appreciated in value relative to other currencies. As a result, gold, which is denominated in US dollars, becomes pricier for international purchasers. As a result, international demand for gold tends to decrease, leading to lower prices.

- Opportunity Cost: Gold does not provide interest or dividends like some other investments, such as bonds or dividend-yielding stocks. When interest rates in the US rise, as controlled by the Federal Reserve, investors may find it more appealing to put their money in interest-bearing assets rather than holding non-yielding gold. This scenario, in which gold competes with higher-yielding investments, can drive gold prices down.

- Market Sentiment: A strong US dollar often reflects a confident and stable US economy. In such situations, investors may be less inclined to seek the safety of gold as a hedge against economic uncertainties or geopolitical risks. This reduced safe-haven demand can contribute to lower gold prices.

The Pandemic Effect: A Recent Example

The COVID-19 pandemic provides a recent illustration of the interplay between US economic changes and gold prices. As the virus gripped the world, economic disruptions and uncertainties abounded. Investors flocked to gold, driving its price to record highs in 2020, as it served as a safe haven amidst the turmoil.

Conclusion: Navigating the Gold Market

Understanding the intricate relationship between US economic changes and gold prices is essential for investors seeking to navigate the gold market successfully. While the US economy's impact on gold prices is undeniable, it's just one piece of the puzzle. A myriad of global factors, including central bank policies, geopolitical developments, and societal trends, collectively influence gold's value.

As you embark on your journey as a gold investor or enthusiast, keep a keen eye on the economic indicators and global events that shape the gold market. Whether you're looking to safeguard your wealth, diversify your investment portfolio, or simply admire the timeless beauty of gold, this precious metal remains a steadfast and intriguing asset in a dynamic and ever-evolving world.

For All Your Gold Needs, Trust Al Romaizan

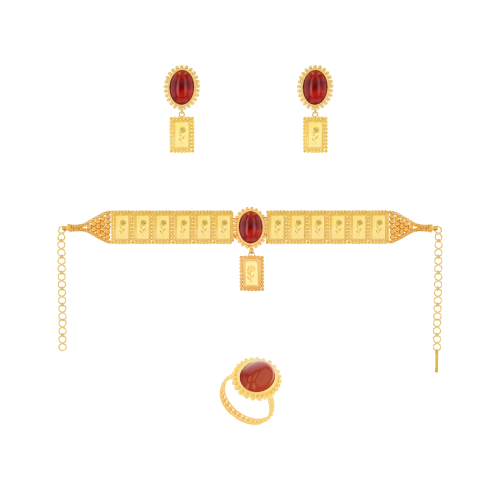

If you're inspired to explore the world of gold further or are considering making a gold investment, Al Romaizan Gold & Jewellery is your trusted partner. With a rich heritage and a commitment to excellence, Al Romaizan offers a wide range of exquisite gold jewelry and investment options. Whether you seek the perfect adornment, a store of value, or a meaningful gift, Al Romaizan's craftsmanship and quality are unparalleled.

As you embark on your journey in the world of gold, remember that Al Romaizan is more than just a brand; it's a symbol of trust, heritage, and uncompromising quality. Discover the timeless allure of gold with Al Romaizan, where tradition meets innovation, and craftsmanship meets artistry.

Explore Al Romaizan's Gold Collections Today.

Discover the perfect gold jewelry piece or investment to match your style and aspirations. Visit Al Romaizan's online store or our physical showrooms to experience the magic of gold.

Our Promise

Fast shipping

Receive your jewelry in maximum 3 days.

Return guaranteed

Requesting a return is quick and easy.

Ethical Sourcing

Ethically Sourced Materials

Payments

Buy in the most convenient way for you.